For other types of businesses, it usually occurs when the cash on hand, left after petty cash expenses, is less than the total amount in petty cash expenses receipts. In this case one balance sheet asset (cash), has been increased by 1,488 when the cash is banked. Notice that the appropriate expense accounts are debited and that cash is credited. There is no need to make an entry to the petty cash account because it still shows a balance of $100. The custodian should prepare a voucher for each disbursement and staple any source documents (invoices, receipts, etc.) for expenditures to the petty cash voucher. At all times, the employee responsible for petty cash is accountable for having cash and petty cash vouchers equal to the total amount of the fund.

The term cash over and short refers to an expense account that is used to report overages and shortages to an imprest account such as petty cash. The cash over and short account is used to record the difference between the expected cash balance and the actual cash balance in the imprest account. As we have discussed, one of the hardest assets to control within any organization is cash. One way to control cash is for an organization to require that all payments be made by check.

Any discrepancy should be debited or credited to an account called Cash Over and Short. The Cash Over and Short account can be either an expense (short) or a revenue (over), depending on whether it has a debit or credit balance. The Cash Over and Short account can be either an expense (short) or a revenue (over), depending on whether it has a debit or credit balance. In this case, we need to make the journal entry for cash shortage at the end of the day or when we make the replenishment of petty cash if there is less cash on hand than the amount it is supposed to be. A controller conducts a monthly review of a petty cash box that should contain a standard cash balance of $200.

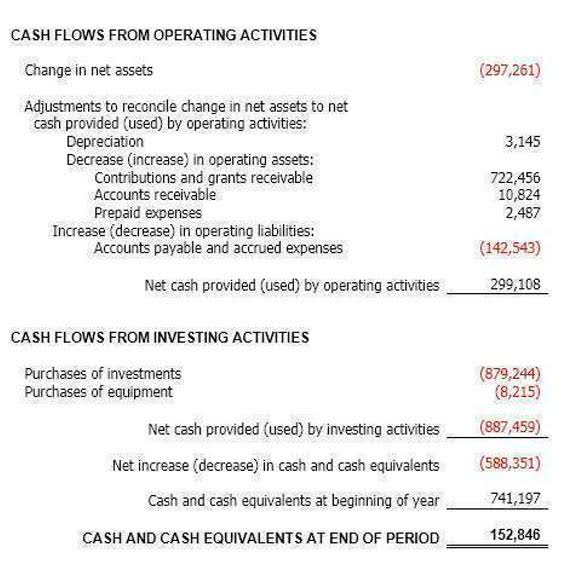

One of the conveniences of the petty cash fund is that payments from the fund require no journal entries at the time of payment. Thus, using a petty cash fund avoids the need for making many entries for small amounts. Only when the fund is reimbursed, or when the end of the accounting period arrives, does the firm make an entry in the journal. The cash shortage may happen often with the retail business as it deals a lot with small notes when making the sales and the cash sales are usually need to be reconciled daily. Meanwhile, other types of businesses usually only have a cash shortage when dealing with the petty cash when it is needed to be replenished (usually once a month). A miscellaneous expense account used to record the difference between the amount of cash needed to replenish a petty cash fund and the amount of petty cash receipts at the time the petty cash fund is replenished.

For example, when you sell $100 worth of merchandise to customer “a”, debit sales for $100 and credit cash for $100. As you think back on this system, note that there are several internal controls in place, most notably is cash short and over an expense account segregation of duties, assignment of responsibility, and a reconciliation (monitoring) process. In the next section, we’ll look at one of the most important cash controls, the bank reconciliation process, in detail.

In contrast, let’s assume that during the cash count, the actual cash from the cash sales is $495 instead of $510. A petty cash fund is established by transferring a specified amount of cash from the general checking account to a person who is given custodial responsibility for the fund. Usually one individual, called the petty cash custodian or cashier, is responsible for the control of the petty cash fund and documenting the disbursements made from the fund. By assigning the responsibility for the fund to one individual, the company has internal control over the cash in the fund. Opposite to the cash shortage, cash overage occurs when the cash we have on hand at the end of the day is more than the cash sales. To record the cash shortfall the business needs to enter the cash shortage of 12 as part of the journal entry used to record the sales as follows.

During the day sales of 1,400 are entered into the register, and a cash count at the end of the day shows cash of 1,614 as summarized below. Suppose a retail business starts each day with a cash balance of 100 in the cash register. During the day sales of 1,500 are entered into the register, and a cash count at the end of the day shows cash of 1,588 as summarized below. Tracking Cash Over and Short is an important piece of protecting a company’s most valuable asset, Cash, from theft and misuse. It may seem like a small item to track, but think of it from the point of view of a retail or restaurant chain where millions of dollars pass through the cash registers every day.