Navigating a medical audit can be stressful, but with a well-defined plan and legal counsel by your side, you can protect your practice’s interests effectively. An IRO acts as a third-party medical review resource that provides objective, unbiased audits and reports. An auditor working as an IRO needs to understand the CIA of their client, including specific who should come in periodically to audit the medical practices finances and bookkeeping practices? terms that may affect the auditing or reporting of the IRO. Comprehensive Error Rate Testing (CERT) is a CMS program conducted annually to measure improper payments in the Medicare Fee-for-Service (FFS) program. The U.S. Department of Health and Human Services (HHS) publishes the improper payment rate in the Agency Financial Report each November.

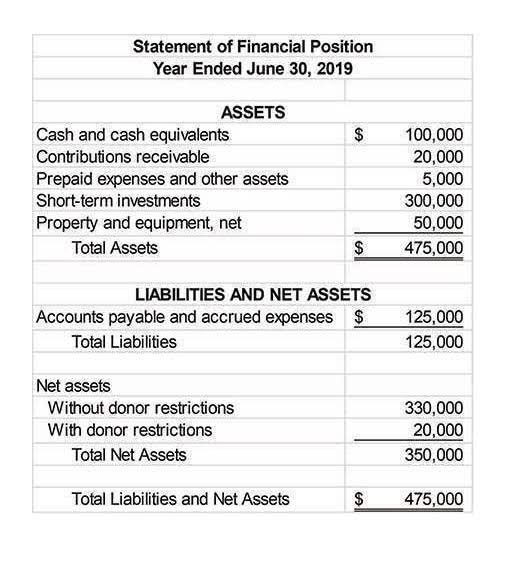

Accrual accounting can be more resource-intensive, often requiring experienced accounting staff or external accounting services. Let us know what type of degree you’re looking into, and we’ll find a list of the best programs to get you there. The employment landscape for accounting careers looks very appealing in New York. Not only does the state house some of the largest workforces in each of the fields listed above, but the wages stand out. The average annual salaries in the state surpassed the national averages for every single occupation.

Bench offers online accounting services for small business owners who’d rather spend time growing their business than managing the books each month. Medical practice accounting is different from accounting https://www.bookstime.com/ for other types of businesses. You don’t just need to account for patient payments—you also need to deal with insurance companies and government-backed programs like Medicare and Medicaid.

These priority projects will be conducted by the OIG’s Office of Audit Services, Office of Evaluation and Inspections, Office of Investigations, and Office of Counsel to the Inspector General. In the competitive field of medical accounting, attracting and retaining qualified staff is challenging. Continuous professional development and a supportive work environment are key to keeping the accounting team skilled and motivated. Some employers and positions require a master’s degree or professional licensure. Since the state has such a high concentration of major businesses, many of the top-paying accounting jobs in the country can be found in New York.

“Most audit requests come with a timestamp on them, and the clock is ticking,” Dr. Blake said. She recommended practices start responding to the audit demands immediately and do their best. If practices need more time to comply, they are more likely to get an extension if they have shown a good-faith effort. No one welcomes the distraction from clinical care and additional work that an audit requires. That having been said, you need to take these audits seriously, according to AMA Senior Adviser Kathleen Blake, MD, MPH. We’re working to remove unnecessary burdens so physicians can reclaim the time they need to focus on patients.

This will allow the practice the time needed to do its own internal audit or to have an outside auditor review the charts. Remember that you cannot alter the charts, but it’s helpful if you can determine if there is a reason the charts are being requested before they are submitted. Staying on top of accounts receivable is crucial for maintaining a healthy cash flow in your practice. If patients aren’t paying you for your services, you won’t have enough cash to pay employees, cover other expenses, and take home profits. If tracking your finances daily isn’t high on your list of priorities, consider outsourcing your bookkeeping to a service like Bench.

These experts specialize in healthcare audit defense, ensuring your practice remains compliant and protected. This is where Uplinq’s specialized medical practice bookkeeping services enable you to effortlessly outsource your accounting needs to dedicated experts. Uplinq’s cutting-edge automation and real-time reporting provide unmatched speed and accuracy in categorizing transactions, generating financial statements, and turning data into insights.

Take a look at this: Biaxin